Michael: Hello everyone, and welcome to the HaBO Village Podcast. I'm Michael Redman.

Kathryn: And I'm Kathryn Redman.

Michael: This is the podcast dedicated to business owners like you who want to have both a successful company and a life. And our goal-

Kathryn: Especially a successful life.

Michael: ... And our goal is to help you with this podcast, with content, that's going to help you be encouraged, educated, and supported because we believe in supporting and building the whole leader for the whole business. And today we have Caleb Guilliams with us, and-

Kathryn: Caleb has been with us a couple times and we're so excited to have you back Caleb. The conversations are always rich and meaningful and we're excited. Let me just give you a teeny bit about Caleb, if this is the first time you've listened to him beyond our show. Caleb is the founder and CEO of BetterWealth, which is a company committed to showing people how to have efficiency and control over their money while maximizing their future wealth potential. The cool part about Caleb is, he's one of these young guys who got in about 15, 16 years old and started reading everything and learning everything, and he's like crazy smart. He's one of the youngest leaders in the industry and really has a lot of respect from a lot of the older leaders out there. And Caleb, we're just excited to have you and-

Michael: Back on the show.

Kathryn: ... Yeah, chat some more and we felt like last time we were talking, we didn't quite finish the conversation, so we just want to keep learning and keep talking.

Caleb: I thought I would do my very best to have something like Michael does on his face.

Kathryn: Well, you know what? Last time we saw you, which was just before Christmas, you were clean shaven, and here you are in your best attempt to not look 15, right?

Michael: You have one of those faces-

Caleb: This is my best attempt. There's a lot of improvement that needs to happen, but I at least can grow something on my face. I wouldn't necessarily call this a beard, but it's something-

Michael: It's looking good.

Kathryn: You got scruff.

Caleb: It's something.

Michael: It looks like there's something there, and that's important. I try and grow a longer beard and it just doesn't look right. Well, she thinks it's nothing, but I've got friends that are 50 and they still can't grow anything on their face, so good on you. All that said, people are going, "Okay, why did I tune in today? This is starting to become a facial hair-"

Kathryn: Is this a facial hair?

Michael: We're going to talk about, oils for beards next. Today, I want to talk about the idea of the financial needs of entrepreneurs. We're different. We're different in so many ways and most people don't even understand it and there's really not that many books or anything else that help us understand it. Talk to me about, how do you start a conversation with an entrepreneur that knows that they're not normal, but they don't know what to do.

Caleb: We met through a workshop that helped us with speaking, and one of the questions that I remember when I was working on my talk is the question on, who's your audience and what problem do you solve? A lot of times when we think of, okay, who is our audience? Let's just say entrepreneurs. What problem do we solve? We just go into solution mode and we're like, "Oh, I solve compounding your money better or I solve helping you retire without stress for retirement kind of deal." I remember the person that was coaching me and I'm sure you guys as well was just like, "The problem that you solve is, what do entrepreneurs do? What is your ideal audience? What are they laying in bed worried about? Where is anxiety coming? What are they fighting about? What are they constantly thinking?"

Caleb: They're not thinking about, can I have a better compounding strategy? They might think of retire, like it could be a form of like, "Hey, I don't want to be doing this job or business for the rest of my life." What I had to really do is, I needed to take a step back and say like, "What are the true problems that entrepreneurs are facing?" I actually want to push that back on you guys, because you have worked with so many people, before I give the answer, because I've done a lot of thinking about this. When I say like, "Okay, what problems do you think entrepreneurs face as it relates to money? What are some of the themes that come up?" Because, if you look at the financial industry and wall street, they're not even close in my humble opinion, and that's why wall street and typical financial planning just doesn't resonate at all with entrepreneurs.

Caleb: But I think through this podcast we can start identifying, "Okay, here's some of the problems and if these are the problems, how can we shortcut and get to a powerful solution for you?" Because if you're an entrepreneur listening to this, the advice and strategies are going to be vastly different than someone who's not an entrepreneur and that doesn't make it right or wrong. It just means that you almost have to do the exact opposite of what 98% of people are doing. With that, I'm going to push that back to you before I answer the question.

Michael: No, no, no. That's really good and also the people listening, there's some that work for somebody else, but this will help you understand a little bit more about what's going on, especially in a privately held company that as thoughts of the founder, owner. One of the things that happens that I've seen for us and for others is, this dualism of they don't ever think about the exit and they always think about the exit. Let me explain that. First of all, when you ask somebody, "Where do you want to be in 5 years or 10 years with your company? How are you going to get out of it?" "I don't know I'm going to sell it" or "I'm going to give it to my kids, because they'll want it."

Kathryn: Of course, they're going to want it. Who wouldn't this company?

Michael: ... "They'll keep running it and support me." There's those kinds of thoughts that happened with founder-owners of companies, especially if they didn't get into buying businesses as an investment to generate cash flow, to flip, that's a different type of business owner, but a lot of family-owned businesses they're sitting there going, "I just have this expectation," but when you ask them, what it is and how it's going to work and how they're going to actually sell their company, it doesn't work well. I remember the very first business class I took right before business class at the local college before I started the company, so this would've been 22 years ago. We're working on business plans for a myriad of reasons from starting companies to finding financing, and there was a gentleman in the back who had run an HVAC company.

Michael: He and his wife were doing this. They were in their sixties and they'd run a successful company, but they realized they didn't know how to sell the company, and they were building a business plan to try and figure out to work on the next five years so they could figure out how to at least exit the company. I remember, I'm at the front end of this thing going, I'm 32 years old and I'm going to start a company in two years and I want to do it well, they're at the back end. Whoa, that's a deal because what kept coming up for the whole semester was the fact that there was so much runway they needed to consider that they didn't really have, or want to have at their age.

Michael: I think that there's that tension of, I know I want to do this, sell it, let's say, but I don't know how, and then when you get into it, they're not doing anything. They have no plan to prepare for that. I think the other thing that happens for a lot of us is, and then I'll let you jump in because you've got that shake in there-

Kathryn: I do. I have something to say, but go ahead, finish.

Michael: ... Is, you just sit there sometimes and lay awake at night, going, "Okay, how do I move the chess pieces?" Because this is all on us, a hundred percent. Nobody's going to take care of us and so security is never going to cut it, let alone it may not even be there, and so there's that, "I don't know what to do." And a lot of times in the midst of pure stress that our leaders have and they're just like anybody else, they go, "I'll come back to this every once in a while because I worry about it, but I don't have a solution, so I'm going to go do something I can accomplish." And what happens is, it just keeps getting pushed off and pushed off and pushed off.

Kathryn: I agree with all of that, and I think the other thing that is true, that if we're honest with ourselves, most of the time for entrepreneurs, for people who start businesses, a lot, are not formally educated. There's this just sense of money is this mystery in some ways. It's this place where there's just a lack of education and so there's this fear of money. I think what ends up happening in the middle of that compounds the problem is that, there's this also sort of this sense of, "I'm supposed to know everything, I'm supposed to have all the answers, so I don't talk about it." Like Michael said, I'm just going to shove it aside because the mindset is, never let them see you sweat, so that whole fear of discovery.

Kathryn: I think money is one of those things they say that statistically in marriage, like what you've got money is one of the top things that causes problems. I don't think that's any different in a business. It is the lifeblood, it's the oxygen, and yet it's the thing that where many entrepreneurs I think are just really scared of, so they're not looking at their reports, they're just hoping they have cash in the bank and then not being sure why something was profitable, why something wasn't, and so I think it's a vulnerable place for people. It sounds like it's cold hard cash. It shouldn't be, but it's very vulnerable and very threatening.

Michael: Does that resonate with things you're seeing and-

Caleb: Oh yeah. I think one of the big things that you guys are saying is clarity, because a lot of problems they stem from is a lack of clarity and definiteness, and that either comes because a lack of understanding books, a lack of knowing cashflow strategies from a standpoint of where are we going to have enough money, a lack of short term, long term. We talk about exiting. A lot of businesses don't even think about exiting. They're just like fish out of water in the system, and so this is the only way that they can operate, but they've never thought about even what the future looks like.

Caleb: One of the things that came to my mind, this was multiple years ago is like, I really do believe that a lot of business owners, there's this dilemma between long term, what am I going to do and what should I do in the short term? Should I reinvest money into the business? Should I put my money elsewhere? It's one of those things where money is ultimately energy. It's like the permission slip to do X, Y, or Z, and we're taught very little about it and in full transparency, even in the financial service space, running a business is different than learning about financial planning. We've definitely had to learn about... Just the other day, we're talking about, can we afford to bring on this person? It's more of a feeling like, "Yeah, I think we can," and then it's like, "Let's actually look at the forecast. Let's actually run our business. Like what is our salary caps? Let's actually run this like a business."

Caleb: I just feel like a lot of that when we're not definite, just comes down to a lack of understanding, and so you get people that either run out of money, fail in business, or hold on to money, and out of essentially fear of I don't know if I can deploy this cash and then as it relates to your personal life, usually the biggest problem that I see is everything's clumped together. What we find is, business owners, there's very little separation from their business and their personal life, and as a result, they don't have anything really in something other than their business, which is very problematic when they're not even thinking about an exit or when the exit's not a fraction of what could be, because their identity and expertise is also tied up in that business, making it less valuable because of the businesses themselves.

Caleb: There's a lot of issues, but some of that language, if you're a business owner, you're like, "Wow. Yes." And when you go to a typical financial planning person, that's essentially saying, "Hey, let's set up a SEP IRA or-"

Kathryn: They think you're insane for what you're doing first of all.

Caleb: ... The question is, is the right solution just to take money and put it into the S&P 500 and hope it compound? I don't know, that's not what got me to be a successful entrepreneur to begin with. It's just one of those things where I'm glad we're asking questions and unfortunately, a lot of financial planners are just glorified employees, pushing products for the company that they work for. I hate to say that, but it's the truth.

Caleb: It's just one of those things where we just have to take a step back and there is a formula that we can go through of, if you're a business owner, here's the step one, step two, and before we talk about investments, let's make sure that we have cashflow under control, and let's really make sure that we have a clear picture of the end in mind, because if your business is going to exit and there's some things that you can invest in the exit, that can create a greater multiple, who am I to say, "Oh no, actually pick your money and maybe compound your money 8% to 12% in other people's businesses that you have zero control over," You know what I'm saying? But a lot of people, they're not intentionally deploying their money in a place, they're just doing it as, this is the way that we've always done it.

Michael: Okay. I feel like we're in the closet, the door's closed or a secret place, and we're hiding with all these entrepreneurs because nobody wants... First of all, this is super vulnerable. Well, money's vulnerable for all of us, but for entrepreneurs who are supposed to have the answers. I'm sure when you said, because you guys are in the financial services business in several different ways and you're going, and you're thinking about running the business and the finances on the business and you didn't have a clear answer, you probably feel like you're supposed to and if you told anybody, you didn't have the answer, that's a little vulnerable too. So then we've got all these owners and they're going, "Okay, I want to hear this, but I don't want anybody to know I'm listening to this." This is the first question, how do we build a learning strategy so we can educate ourselves? What do you suggest?

Caleb: Another way to ask that question is, what is some of the key pillars that we can start figuring out what we should do or?

Michael: Well, yeah. I mean, there's no books. I don't know any books. You and I have shared titles and we've talked about different stuff and we've read some of the similar books-

Kathryn: And you wrote a book.

Michael: ... And you wrote a book. But even still, there's very few that go, "Okay, you're an entrepreneur and this is how you're going to handle making sure you have enough finances for college education and retirement and all this stuff." Where do you start? Because it's a different perspective, like we're talking about.

Caleb: We'll go and look at the Robert Kiyosaki Cashflow Quadrant. I think it's a good place to start and if you are not familiar with Robert Kiyosaki and the Cashflow Quadrant, he's one of the best known, I think authors when it comes to financial independence. While I don't agree with all of his concepts, I am a big fan of his and the Cashflow Quadrant essentially says that, there's four ways that people make money. They're either employed, they're self-employed, which is most entrepreneurs, they're business owners, or they're investors.

Caleb: It is very possible to make money in multiple quadrants, but his whole deal is business owners and investors have an advantage when it comes to taxes, leverage, and all that. And if you're an employee that's still fine, that's totally okay, but you're paying more taxes. The goal is if you're an employee to try to figure out, can you also be an investor so that you can start creating wealth. Probably a lot of people listening to this, you're not a business owner, you're a self-employed person pretending you're a business owner.

Michael: What's the difference? Let's define the difference between those two real quick.

Caleb: Self-employed is essentially a slave to themselves. That's not the Investipedia definition, but if you leave, there's no business and majority of business owners, and by the way, I'm a part of this, is the hardest working people in the company, and if they stop working, the business is going to struggle. Do you really have a business? Are you working for yourself? And that still might be better than working for someone else, but let's be honest, you're paying even more taxes than even people that are employed because of our crazy tax system. But then on top of that, you end up working more than 35, 40 hours. A typical a self-employed person that's running their own business is working 60 plus hours. Again, it's not like there's seasons for that, I would argue that anyone that's starting businesses has to start in a self-employed quadrant and then needs to think about how they're going to move up.

Caleb: It's not bad, but majority of business owners and you and I both know this, never get out of that quadrant. The first thing, and I don't know if you want to say anything from that, because that really ties into what I'm going to say about money, because one of the things that we need to do is separate, we need to separate ourselves from the business. One of the most no brainer things that we need to do, if you're running a business that is an asset. You need to separate yourself from that, which means there's two ways to get paid. You pay people for the work that they do, and then the owner gets paid in the surplus or the profits of what that asset produces.

Caleb: People ask me all the time, Caleb, what things do you invest in and all this stuff? Yes, I do have some crypto holdings. Yes, I do believe in real estate. Majority of my wealth is built up in businesses. I own multiple businesses. I love it. But I see it selfishly as assets that are super under priced, because while people are investing in the stock market, super efficient market, which means the prices are really on point, the real estate market's pretty efficient. It's less efficient than the stock market so there are opportunities. I think businesses, if you have the it factor, is like the Wild Wild West, and you can buy businesses for pennies on the dollar and crank them up and either sell them or cashflow them.

Caleb: All I say is, a business for me is an asset. It's not a dream job that I have, but from that to happen, you need to separate and majority of business owners are not separated and so they're very much in the self-employed quadrant. The first thing that we need to do is, we need to start separating that, we need to start analyzing, do you have a healthy business or you just to yourself? And is business is really not profitable, because you're not paying yourself. Majority of people, if we can start that separation, they're already 85%, 90% on the way to being successful because, now we can talk about what you're personally going to do with your money and then should the business pay the owner or should it double down in your business? It's an easy equation. It's like, what's going to get you a greater rate of return.

Caleb: I don't want to simplify this. But majority of business owners listening to this, are really caught into, it's more of a bookkeeping. They need figure out how to separate themselves and stop lying to themselves and from there, you're creating a foundation that you can start building wealth on. That's the epiphany that I had after writing my book, The and Asset. It's a special strategy using life insurance but the reality is, it doesn't have a really powerful effect until you have that separation mindset. It's definitely something that comes like fourth or fifth in the strategy, not the first, and that's one thing that I've learned in working with a lot of business owners is like, we need to get accounting figured out and really get clear on what the goal is, before we start investing or saving our money.

Kathryn: Are you arguing, and just so I understand really clear, are you saying that if you own the company, you should never be a W-2 employee?

Caleb: No, I'm not saying that at all.

Kathryn: [crosstalk 00:18:48] You're all not saying that? So clarify that.

Caleb: I'm saying that, if you work for the company, you should get paid for the work that you do, but that needs to be separated from the owner. For instance, let's say you guys own a company and you work there and you run marketing. The company should pay you for the work that you do, just like if you leave, you'll have to replace yourself and so you pay yourself on what you are willing to pay someone else to run that. But then if the business makes more money and wants to pay its owner, that owner should get paid regardless if they're working or not, because they own the asset.

Kathryn: Got it. That makes sense.

Michael: It's a pretty straightforward context. Look, if I'm doing work, there's work to be paid, but then there's also, my investment needs to pay for itself and hopefully the investment is more and more profitable. Now, when you own the business and you're taking home a paycheck and you're taking home investments and you're doing the accounting tax issues and stuff like that, it gets a little muddy sometimes because you're thinking, especially with us, let's take us. We have two companies. I can look at the other company, I go, it's paying us back a certain amount of money and building up at also a reserve for a sell at some point, hopefully in the next five years.

Kathryn: And we're taking a salary for parts of the stuff that we do in the company.

Michael: Yeah. For a long time, the company couldn't do that. Now the company can do some of that-

Caleb: That's amazing,

Michael: ... Which is nice because now you just get paid a little bit for actually being advisory and stuff like that, because our partner runs the company day to day operations on the company and we work in with leadership and a little bit of other stuff. That said, we have this company, this is our primary thing, our primary paycheck comes from this. And when I say paycheck now, I'm using that concept of the amount of money we live on is both what we get paid and the investment, the profit of the company and how well it does. Now, I know that there's lots of room to grow and clarify, but that muddiness of, when we talk about how much money do we make, like we want to buy a new home. The bank goes, how much money do you have?

Caleb: Yeah. They're looking on your personal side.

Michael: Yeah. And we're an S Corp, so [crosstalk 00:20:59] everything runs down. Emotionally or even mentally keeping track of... Are we just talking about an Excel spreadsheet sell at this point because that's what it feels like. It feels like what is profit for being a business owner and for what's being paid is a discussion that is like, well I'll put this number here and I'll put this number here. Is there more logic or thought or extension that goes to that place, just to that issue, because that seems like a stumbling block of confusion.

Michael: If one of the goals to this financial freedom issue, especially making sure that we're taking care of short term and long term in our life, one of the goals is clarity. Clarity on what our goals are and clarity and what's happening right now. It seems as though the very nature of owning the business and working in the business and being the business owner as this theoretical concepts that we're separating right now, we're creating, how do you decide what's what? Because, it seems like it all gets sort into one pot. At the end of the day, it's all the money you get to spend, invest, hoard, hide under the mattress, whatever you want to do.

Caleb: I'm going to try to draw while speaking, not draw figuratively because I want to walk through the process.

Michael: We can take some screenshots and put it on the-

Kathryn: Fell free to draw, draw.

Caleb: I'm going to do this. This will be the first podcast that I've ever drawn.

Michael: How exciting.

Caleb: The first and foremost is, I'm drawing a person, and this stick figure just represents you, your family. What is really important to you? I know that you guys have seen this before, but it's like, what is your return on result metric? What is the metric that you should be making decisions? This has really little to do with business, little to do with investing right now, and it's just like really answering the question, if money wasn't an issue at all, what would you be doing? And getting really clear on that. I could spend a whole day talking about the value of your life. Why we only have one life, let's maximize it kind of deal, all that. That's really important and until we get really clear on that, I could say a lot of things, but it really doesn't matter until you have crystal clarity on what you actually want, which majority of people in life do not and so that's where we could make a whole business in itself just helping people get clear on that and there's a lot of people focused on that element.

Caleb: Once we get focused on that, the most important financial metric is cashflow, because cashflow is what pays the bills. Cashflow ultimately, retirement planning should be called future cashflow planning for being honest, because you are doing all the things you're doing for a day that you can get cash flow, and so everything that we do now and in the future, cashflow is the metric that keeps businesses in business. If you stop paying people on your team, payroll's a form of cashflow and you're not going to have a great team over a long period of time.

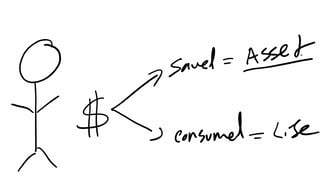

Caleb: Cashflow is a really important metric. When you have cashflow, your cash can only do two things, and this is true for a business and personally. It either can be saved, and this is a verb, it's set aside to invest or it can be consumed, and consumed could be anything like taxes, could be paying employees, it could be paying for your kids' college, it could be taking your beautiful wife on a date, it could be anything and the whole concept of consumption is essentially when you lose a dollar, you don't just lose that dollar, but you lose that dollar, the rest of your life. On the personal side, consumption equals your lifestyle. On the business side, consumption just equals the cost of doing business. So saved equals of the verb, which then is re-invest. And my favorite reinvestment concept is an asset. My definition of an asset is something that helps you live more intentional.

Caleb: Robert Kiyosaki's definition of an asset is something that puts money back in your pocket. Investopedia's definition of an asset is something of value that would show up on a balance sheet deal. Definitely, when we're saving money, we want to invest in assets and not all assets are created equal. Let's just take... I'm going to use you guys an example. This is you, and you have cashflow and you can either, let's say now in your business, money that's consumed is the cost of doing business. This is paying for technology, team members, travel, and that money is allowing your business to keep moving. If you could say, it's like investing in your business right now and good things are going to happen. You're still able to live your life and overall, at the end of the day, whether you spend a dollar on a business travel or personally, it's gone forever.

Caleb: The money that's a surplus is saved and this saved money could either get passed on to you or it could be reinvested in the business. That's a question that you need to decide, and then once you get that money, it comes in form of a cashflow again to your personal life. And then you say, are you going to live life or are you going to invest? If invest, you could invest it into an asset. Well, is a business an asset? It is. Then the question is, are you going to invest back in your business? Are you going to invest in real estate? Are you going to invest in the stock market? And it really comes down to where is the best yield? Where is the best result for my dollar? One of the things that we try to do with businesses is number one, when we're talking about a personal life and business life, we need to separate them. We first and foremost need to say, what is the goal of business and how do we run the most efficient business?

Caleb: We need to be efficient with the money that's being consumed, and the surplus needs to either be like... Every business should have a reserve and all that stuff and so the question is, is this better off reinvesting back in the business or getting passed down to investors. Every business comes to that and obviously you need to pass down some to the investors' i.e yourself, but some will pay themselves more or little, and it goes back to the stock market investing. You could invest in dividend paying stocks, which they're essentially saying, instead of putting all this money in growth, we're going to pay back to the investors and a lot of people love that. But what they're essentially doing is instead of investing in growth, they're investing back in the business. That's an example of a lifestyle and entrepreneur that's making money and living off of most of that profit.

Caleb: Like at the end of the day, they're totally fine. Not like they're totally cool with a couple hundred thousand, couple million dollars coming in. They don't want to be a billionaire. That's totally cool. Or you could be a lot like myself and say, "I will live off little as I can today and reinvest in the machine, reinvest in acquiring other businesses." Well, there's trade off there, we're buying assets that hopefully grow the business, grow the future cashflow, but in the short term, I'm getting paid less.

Caleb: Once I get that money personally, then obviously I have a lifestyle, but then I need to choose where I'm going to be investing that money if I have any money saved. Maybe I just complicated everyone 10 times more, but really we have to think about business and personal life, and whether you think you've separated or not, there is two types of people. A lot of people spend a lot of money through their business, but they need to account for that because their consumption shows up a lot in their business. Again, I can't see you guys as I'm explaining this, but what thoughts do you have and questions?

Michael: What are you thinking? Questions? What are your thoughts, Mrs. Redman?

Kathryn: I think it's funny because obviously, we're sitting across from you as people who own a couple of businesses and help other people try and figure out their businesses and have that privilege and have approach things. I think in our younger years, we didn't have any financial education. We understand what it is to be starting with... Michael had done his video series and all that stuff, but even just thinking early on, how do I decide to pay myself more? How do I decide whether to take more or put money back in? How do I evaluate if my bottom line looks tiny because I chose to reinvest? How do I emotionally remember that, I didn't waste that money? Actually, it's building the business over here.

Kathryn: Again, there's so much just trying to find that clarity of what it is that I'm doing and why I'm doing it, and then keeping that strategy in front of me, is always the rub for me. The other piece that gets really dicey, and I don't know if this is true for other entrepreneurs, is that ultimately you get to talk to your tax guy and if your tax guy is really traditional, it can get a little bit challenging because they're like, "Okay, but why did you do this? And why didn't you do this?" and that's an interesting place to be too when you're interacting with the professional, and you're having to defend why you did what you did as an entrepreneur.

Caleb: And this is not a pitch to work with us or whoever it's just-

Michael: Oh, pitch.

Kathryn: Oh, go ahead.

Caleb: Everyone is a little bit unique, and so you got to work with somebody who can understand that and then help you measure that, because there are people that are reinvesting in their business that shouldn't. They'd be better off paying themselves and reinvesting into a Roth IRA, and they would actually be better off in the future because their business' asset is not as efficient as it should be. Like investing in your business is not always the right answer, and some people are like a $50,000 employee away from 10 Xing their business. It's just one of those things where you should put a metric on anything. I know Kathryn, you're not the most analytical person I know, right?

Kathryn: Yeah.

Caleb: But you need to work with someone that can help you understand to be like, "Okay, either this or that." And it should be really clear, if you're not going to double your business, you would actually be better off paying yourself or the exact opposite, if you can increase your business by 10%, this affects this bottom line. One of the calculations that we run for people is this concept of bloat and a lot of businesses, if they think like, "oh, I could just make more money. I could just make more money, I could just sell another thing. I could send another email and raise more money kind of deal." But when we show them, okay, you have a 10% profit margin, which is actually really healthy for this example, what you need to do is you need to make for every dollar, we save you, whether it's a tax strategy or cutting out an inefficiency, as it relates to technology that you're not using, or maybe firing someone that shouldn't be working in your company, for every dollar we save you, it's equivalent of you making $10.

Caleb: It's like, is it easier to save $10,000 via tax strategy or go make an extra a hundred thousand? That's just an example of saving money is greater than making money, and a lot of entrepreneurs just don't have an equation for that. That makes sense, theoretically but we're not working with someone that can help us show that so that we can say, "Hey, would we be better off doing X, Y, or Z." This is really complicated stuff that we're talking about. Personal finances are actually very simple, when you do business, it's really complicated because to do it right, you really need to separate yourself, but this is our baby. We gave our blood, sweat, and tears to this thing. What I'm not saying is not to divorce yourself emotionally from it. I'm just saying, that's why so many business owners are struggling, is it's like, there's very little separation and then it's just really hard to be accountable to yourself if there's not that separation.

Kathryn: Interesting. What questions do you have of all of that?

Michael: I find myself thinking multiple things. I think one of the things that... I personally conceptualize a lot of this. But where I really stumble and struggle is, when it comes right down to, how do you track the numbers? How do you actually associate that? For instance, you and I have in the last three years, a little bit of vulnerability here with folks in the last, not tons, but a little-

Kathryn: Embracing myself.

Michael: We've taken money that the company has had and we've invested instead of... We've done several things to reinvest in ourselves that has not generated the revenue we'd hoped yet. We wrote a book, we invested in some courses to try and be more prepared for public speaking to sell, and then COVID happened.

Caleb: Yeah. That was bad timing.

Kathryn: That was rough.

Michael: Great investment there, maybe it'll pay off in two years. We're investing in some education in ourselves. We've invested in pulling people in that are smarter than we are, and working with some consultants, and we've invested in ad buying, and labor for our staff, that they could have been working on a client that we could bill out, we're taking that and using it in. Caleb, I've got multiple pockets, we've got a theory going on here of reinvestment versus paying yourself and reinvesting in the asset, but now I just described like four totally different ways of taking money and reinvesting in the company on a monthly basis or a weekly basis of, here's cash, it's going to be go in. These things we could write them off as expenses, but really if we chose not to do X, Y, and Z, there's a lot more money that falls to the bottom line than I can take out of the company.

Michael: Now, I've got a company that if I had ignored it, and this is where it starts to get even more complicated for a lot of us is, I get to the end of the year, and Kathryn and I are having a conversation. We're like, "Well, we have a 5% profit on the company, and that's all because look at all these expenses, and this is what our tax guy said," but then you go back and you go, "Yeah. But we dumped another $200,000 into things that could or hopefully will eventually because it takes a while out to generate cash, almost new businesses within the business" and all of a sudden you're finding yourself going, "How do I track that and the details of the money so that I actually have a clear conversation," because without that the conversation gets muddy and you start going, "Well, we sucked this year because we only made 5%," when really we probably made 15%.

Caleb: A very extreme example is that some of the most profitable businesses, or I shouldn't say the most profitable, some of the most valued businesses of the world, i.e Amazon for the longest time, didn't show any profit because they were reinvesting in themselves buying other companies and did that pretty strategically. I think the answer to your question is, are we trying to sell the company for a multiple in the future or are you trying to increase cash flow? And there's probably a combination of both for a lot of entrepreneurs, and so every initiative that you do, if it's an employee, if it's a workshop that you attend, if it's coaching, we really do need to get really clear on expectations and what the value is of those expectations. Because a lot of times, and I'm the chief among sins here. It's like, I just go off of a gut feeling like, I really think this is going to turn out.

Caleb: One of the things that we've done and is like... You tell me is spending $10,000 to speak at an event and sponsor an event, a good investment? That should be it. Pretty easy to track. We spend this much, my time's worth this, this is the cost of all said and done. So we put $15,000 into this event, what are the value of the relationships? What are the value of the immediate business? What are the value of the future partnerships? It's hard because some of those relationships and partnerships develop-

Kathryn: There're not going to fall in the same year or the same month.

Caleb: It's one of those things where, what is our timeframe? And when you're talking to someone like me, my timeframe is 50 plus years. So it's like, I will always be reinvesting and-

Kathryn: [crosstalk 00:36:55] it's younger than I am.

Caleb: Right. The whole point is, I hear you, and it's really, really tough and you're inspiring me to go back to our team. We actually, we own deriba.com, which Deriba is the first word for tax in the Egyptian language, so stay tuned. We're going to get into tax game hard because if you ask me, what is the number one problem that business owners face it's, they need a CFO, and they need to start getting better with their tax strategy. And we as a company, we are super committed. This is one of those things that we're probably going to launch at the end of this year. But like you want to talk about investment, we spend a ton of time and money, pre-launching this business to do this right, and you're inspiring me to go back and figure out how we can answer these questions because I do believe there are solutions and answers to all your questions.

Caleb: This is what business owners are struggling with. We should be able to have something where they can type in like, "Hey, I'm going to invest $65,000 into a team member." Boom, these are the results and then they put a value on those or results and it should kick out a rate of return. It should say, "My CPA is saying, I should invest in a 12% 401k. I'm going to get a tax deduction over here and so all these benefits... And you should see real quick, should I reinvest in my business or should I do this? It's actually really simple, but very few people have actually made that clear, and just to be clear, we're on a mission to doing that. We're not taking clients at this moment, but it's the number one thing that we're focusing on because it's going to make such a big difference.

Michael: I'm a firm believer that everybody's got certain gifts that they bring to the table and yes, there's skills you can learn and you have to, but not everybody's gift or love language is spreadsheets. Those people in our lives, if we have them that understand that and can do that comparison, because for me, I have to have a conversation with those people and regularly asked them to clarify, because it got muddy again, even though I'm looking at the spreadsheet they created. But it's critical to have, and our business partner and our other company, that is his love language of spreadsheets. Which has always presented a little bit of challenge in other areas because he's so good at spreadsheets and he's grown a lot, as a leader and as a business guy, but we had an outsource CFO for several years and then he shifted careers.

Michael: We're one of those companies that are going, "We can't afford a full-time CFO, but we're in the market again for a outsourced CFO." He was incredibly helpful. To an example of one of these things, he and I were having lunch one day and he goes, "I've got this client over here that has a $50 million company. He always thought his kids wanted it. His kids don't want anything to do with it. He can't give it to them," and here's an asset that has a fair market value of $50 million, but finding a buyer for a $50 million asset in his industry, which is agriculture is a very, very difficult thing, so value is only as much as, somebody will pay for it.

Kathryn: [crosstalk 00:40:03] Willing to pay.

Caleb: I love that, you guys said that.

Michael: ... And so he's got that, he's getting to the place where he wants to retire and figure this out, and this is what our friend/CFO said to me across the table. He goes, "Your company, Half a Bubble Out at the moment, is never going to be a company that we're going to be able to sell easily." His recommendation now at our age is, you start taking money out of the company now. It's either going to be something that we're hiring people to, and it's going to cashflow, part of our strategy is increase the cashflow because we've got a leadership team involved and it's continuing to pay us or we're taking money out and trying to figure out how that increases over time on a monthly, yearly basis, so that when it's all said and done, we don't have to worry about selling it. We can shut the whole thing down if we want to, if there's no buyer out there and go, "We did get our return on investment out of the company."

Caleb: Or you could hire an operator and cashflow and attend the quarterly leadership meeting and make sure the vision is still on. That's one of the things that we do right now, even without our CFO side of the business is, we help people put a cashflow value on their business. I love the people that are like, "My business is worth $3 millions kind of deal and so we could actually model." All right, you sell your business and it's insane how disappointing that looks, and they would be much better off paying someone $200,000 a year to run the company and take cashflow, and it's just cool it's like, this is not super complicated, but it's like, your business might be worth 3 million, number one, is anyone going to buy for 3 million? Maybe, but then number two, your business is actually worth 6 million if you look at it from what it's worth to you right now, when it comes to cashflow.

Caleb: It helps people start thinking about, "Okay, maybe I should just think differently about exiting and get a better result." And for someone like you guys, you guys are a perfect example of you love what you do. It's like, you're going to be impacting people's lives to the day that you die, and so it would be cool to be in a place where you don't have to do X, Y, or Z to have that impact, which that's the route that you guys are going. But that's just a different way to think about exiting a company. You're totally right, people are getting crushed when it comes to selling, especially with taxes and a lot of times their standard of living decreases because of 5 million cheque today after taxes, is not as powerful as that asset cash flowing the rest of their life.

Michael: It's really good. That's the model we're considering over on the retail side for pet food, because pet food's a consumable. It's like owning toilet paper, we find out and people love their pets, and we've talked about it. It's like, "Okay, do we sell the company for..." In the next few years, if we got a 7X on the company and I think it's possible to get it in the current market, it would be possible to get a 7X from investors that are in the pet food industry off of what we have, so that's fine, that works. I couldn't get a 10X, but 7X, I think it's close and reasonable. But at the same time we're sitting there going, "Okay, well, if we have a $10 million a year company, and it's bringing out 10% revenue, a 10% profit that we could take after it's supporting itself and growing and investing in itself and everything else, I mean-"

Kathryn: Do we really want to give that up?

Michael: ... Do I want to give up $500,000 a year, as half of, because I own half the company?

Caleb: You're asking the right questions and the people listen to this podcast, I've never had a podcast like this ever. I apologize maybe or you're welcome maybe, because we're just talking, this is not scripted. We're literally talking whether this is recorded or not. These are the conversations that business owners are struggling with and it's real. Last night, we're talking the conversation of raises, hiring, investing in technology, and it's like the financial company is having conversations or arguments or however you want to debate, the best way to do it. And one thing that we all had in common is, we want the best thing for the company, but they don't necessarily have a 101 for dummies when it comes to this, and so these are the conversations that need to be he had.

Caleb: But the first and foremost is, you need to get clear on what you want and what is your metric for success, because there are certain people that are going the venture capital route to sell a company and while that's not for me right now, their metric is exiting in three years. They're going to do whatever they can to freaking grow the value and in my humble opinion, a lot of times they're cutting a lot of people off at the kneecaps with that model, but their goal is exiting. There's nothing wrong with that but my goal right now is not exiting.

Caleb: I would run BetterWealth totally different if that was the case to be acquired. It all depends on what your value metric is, and then from there it's doing the best you can in investing in the greatest return on result for you, which may mean doubling down on business marketing, or it may mean diversifying and building a real estate portfolio, there's not a right or wrong answer, that's why you do need a coach and that's why you do need, whether it's a full time or a fractional CFO that can help you start making decisions because the spreadsheets are important, but the people that just do spreadsheets have a really hard time investing in fuzzy ROI. You need a balance of-

Kathryn: People, humans.

Caleb: People are like, "Caleb, you got super lucky." It's like, "No, I've just invested in my luck surface over the last five years." I've a lucky luck surface, but it's not on accident. It's not like something fell out of the sky and hit me over the head. I've been doing this a while and I invest in relationships and I can't tell you right now what the ROI of being a kind human being is, but it's done well for our business and so that's always a fuzzy ROI.

Michael: Well, I haven't seen any cash yet, but I think you're good at ROI in our lives and I appreciate you very much. Let's wrap this way today. What happens a lot with Kathryn and I and our conversations with folks like you and with you specifically today is, this is a conversation we would have if it was late in the evening, it was after dinner. We're sitting on the back patio in a beautiful spring day and drinking our favorite beverage and we're just talking about life and we've been there for a couple of hours and we're hashing and we're going, "This is what I'm happy about. This is what I'm driving towards. This is what I'm proud of, and this is what I'm scared of or nervous for."

Michael: I've been talking to a lot more entrepreneurs lately who are like, "I don't have much cash." And I'm like, these are people that I have seen and worked with that have great size businesses and they're like, "The majority of my cash, like 90% of it's wrapped up in this company. How am I going to get it out? Because right now the company..." One of our friends said, "This company can't afford to write me half a million dollar cheque, and I don't know how it's actually going to come out and what the plan is because it's not simple."

Michael: We're sitting here, we're having this conversation and letting people listen in, to a real conversation that happens that they may have had themselves or wanted to have, but wasn't able to have it with somebody because nobody got it, because they're that alone or they don't have that right people. I'm assuming they're sitting there and they're going to go, "Okay, this has been amazing. This has been super helpful because I feel like I'm talking and listening to somebody who understands me." This is the question before we all go, "I'm going to bed, I'll see you in the morning. Well, what do I do? What's my next step?" I've got my own thoughts, but Caleb, we're sitting there, that's the scenario. What do you tell our friends sitting next to us, he or she? What do they do tomorrow when they get up?

Caleb: It's a great question and I'm like, "How can I make this sound better than it's going to sound?" It's tracking, it's start knowing your numbers. That's the real... If I could encourage everybody to figure out a system to actually know your numbers, that is the solution or building the foundation to actually answer your question, because a lot of people don't know their numbers, so they're going to be based on a gut feeling, which is fine, but it could gut-

Michael: Let's stop there for a second. I get that, that's great. I'm putting myself in their mindset now. That's great. I actually have been trying to do that.

Kathryn: How do I get to know my numbers?

Michael: But where do I find help, because I can't do it myself? I've been doing this a long time. I don't have what this 25 year old or 26 year old is telling me, he's smarter at this than I am and I can't hire him today. What do I do? How do I find help? Do you have an answer?

Caleb: There's a reason we're starting a company, is I get this question on a weekly basis and it's hard for me to answer. I do have some people and again, if I don't necessarily feel comfortable dropping their names on podcasts. But I do have some people that are phenomenal at CFO, especially if you're in the internet marketing space, I would trust him with my company and my life, essentially. I just know his integrity and character. But the reason why we're doing what we're doing is, I've been appalled personally and I've been appalled just in looking at the lack of... I'm telling you it's insane.

Caleb: The lack of accountability in the space and a lot of CPAs are just glorified. I'm not going to say bookkeeper, there's glorified like fill up this paper and will save you. It's insane. So many people are flying blind and we wonder why businesses are failing and people are making dumb decisions as they don't really have anybody in their corner. As an entrepreneur, I'm like, "Man, there's a massive opportunity because if I'm struggling with this and I love spreadsheets, how the world is majority of business owners operating?" I always wonder, how would do businesses stay in business? Knowing economics and all this stuff and you just wonder-

Michael: 90% of them don't.

Caleb: That's a good-

Michael: And only 4% of the ones that do make it to seven figures, that's the answer. If somebody's listening going, "Okay, well what does Michael and Kathryn think? There's a lot of agreement here and this is one of the reasons not only because we enjoy Caleb, but we really see a lot of alignment here. I've been seeing this for years. This has been a need that we had. This has been a need that our clients have had, and the short answer is, there are outsourced CFOs out there folks especially, if you're small enough and you can't afford a full-time CFO. Just because you can afford a full-time CFO doesn't mean they're actually a good CFO. Unfortunately the bad news is, we've seen several of those that didn't work out for companies that have a lot of money to spend that can afford the salary.

Michael: The good news is there are some great ones out there and we've had some phenomenal experiences with two outsourced CFOs in the last 10 years. The reason we don't have them is because they made career shifts, that again, everybody's moving around and so you don't always get to keep somebody for a really long time. We see the opportunity too and there are a couple of companies, if you have interests, please, we're not going to recommend people on this podcast, but contact us at Half a Bubble Out, and we'll point you in a direction, whether it's to Caleb or whether it's to some of the referrals that we have, that might be a good fit for you and you have to talk to them and ask them.

Michael: But this is going to be a need more and more folks like Caleb and folks like Half a Bubble Out, us, are going to be working on this more and filling this and I would anticipate that there'll also be some partnering in some relationships between Caleb and us as we go forward, just because we've talked about it, but these are needs to where you find these people that you trust, because that's the key, is finding the people who have the competence and the skills and people you trust and then you have a good conversation and you continue to keep the communication open. That's really the bottom line, critical aspect of it and if everybody's willing to learn and grow in that conversation, then it's amazing.

Kathryn: Well, and I think too, if nothing else out of this podcast, there's been a ton of stuff, but I also would want to say out loud, if you're struggling with knowing how to manage your finances and you've felt any sense of shame or lack or like I'm just not smart enough, just know that you are so normal.

Michael: You're not alone.

Kathryn: You are not alone. Like Caleb said, he's having this conversation every week. We're having these conversations all the time with people, so don't let the fact that you don't understand and you realize that you don't get it, don't let that stand in the way of getting help because if you're sick, you go to a doctor, right? If you don't know the answers, just pretending that you do or faking it is not going to increase your health and it's not going to increase the health of your company. It's not going to increase your bottom line, so don't be ashamed to need help. We all need help. As we often say, you cannot always read the label from inside the bottle. Getting that outside perspective and not feeling like I should know more, I should understand, it's really okay that you don't, so take the risk.

Michael: Any last words for our folks, Caleb?

Caleb: Man, this has been a fun podcast and I want to thank you guys for your heart in this, your willingness to be transparent. I think it goes back to the Bible verse of, what profits a man to gain the whole world and lose their soul? One of the things that, if I can do so it's like, yes, all this stuff is important, but I'm just so grateful for the people in my life and you guys included that really helped me stay aligned to what is really important and make sure that I don't end up forfeiting the things that are the most important in my life to hit a certain number or a spreadsheet or make certain decisions. In light of all that, that ultimately is the greatest filter metric that I use and I'm grateful for the community and people that help whether it comes to investments or being better leaders or better communicators, because all that stuff matters. I just want to thank people for taking time to listen to this and I'm really grateful for the intentional conversations and future intentional living moments that we're going to have together.

Michael: I like that.

Kathryn: Yeah. We feel the same. Caleb, we appreciate you just sharing with our audience and being willing to take the time out of your life and your business to do that. It's critical. It's super important information. We're really, really grateful that you joined us again today.

Michael: If you're listening today, before you hit exit and stop on this, I want to just say, look, 90% of businesses fail, 4% don't make it to seven figures. There's a tremendous amount of companies that just go by the wayside. If you are in that place where you're wondering where you are or you've been around a while and you just have been hitting a wall or hitting that next ceiling and want to go grow, our entire goal and desire of this podcast and our company at Half a Bubble Out is to lower that 90% failure rate, increase that 4% rate of people making it to seven figures and above and to be able to build that community that develops the whole leader for the whole business so that you are actually doing better financially, answering these questions, thriving more as a company and as an individual-

Kathryn: Sleeping better at night

Michael: ... And your stress is less. And really because what we don't want is you in burnout and too many times, it's like the conversation is, do I choose profit or do I choose burning myself out? And we believe there's a third choice. You can choose to have a successful company and not being burnout, but it takes wisdom, it takes community, you got to learn some stuff and you got to implement some stuff and it is possible. We've done it, Caleb's done it, and we have lots of friends in our community that have done it, so we want to just encourage you today. And I hope this has been helpful. Have a great day, do some thinking about this and come back and join us for the next episode. I'm Michael Redman.

Kathryn: And I'm Kathryn Redman.

Michael: And this is the HaBO Village Podcast.

Kathryn: Have a great week.